Client: Nuvi Inc.

Role: Senior Product Designer

Date: Feb 2023

US Banking for foreigners

As the lead designer at Nuvi, a Neobank catering to foreigners looking to access US banking services, I was tasked with creating a user-centric digital platform that simplified the complex process of opening and managing US bank accounts for international users.

Global Access

Nuvi was founded to address the challenges faced by non-U.S. residents in accessing traditional banking services in the United States. The goal was to create a fully digital, secure, and intuitive platform that would allow users to open U.S. bank accounts remotely, manage their finances, and access banking services typically restricted to U.S. residents.

Constraints

The project had to navigate stringent U.S. financial regulations, ensure top-tier security, and accommodate diverse user needs from various countries. Additionally, the platform needed to support multiple languages currencies, and integrate with a number of 3P providers for various banking technical services (operations, foreign transfers, virtual credit cards.

Team & Role

I collaborated with a cross-functional team, including Business Leadership, Project Managers, Engineering, Compliance, and Customer Support. My role involved leading the UX/UI design process alongside 2 contract designers, conducting market research, and ensuring that the platform met both user needs and regulatory standards.

Research

To understand the needs and pain points of our target audience, we conducted in-depth interviews with potential users from various countries as well as looked deep at the competitive landscape. We focused on understanding their banking habits, the challenges they faced with existing U.S. banking services, and their expectations from a digital banking solution like Nuvi.

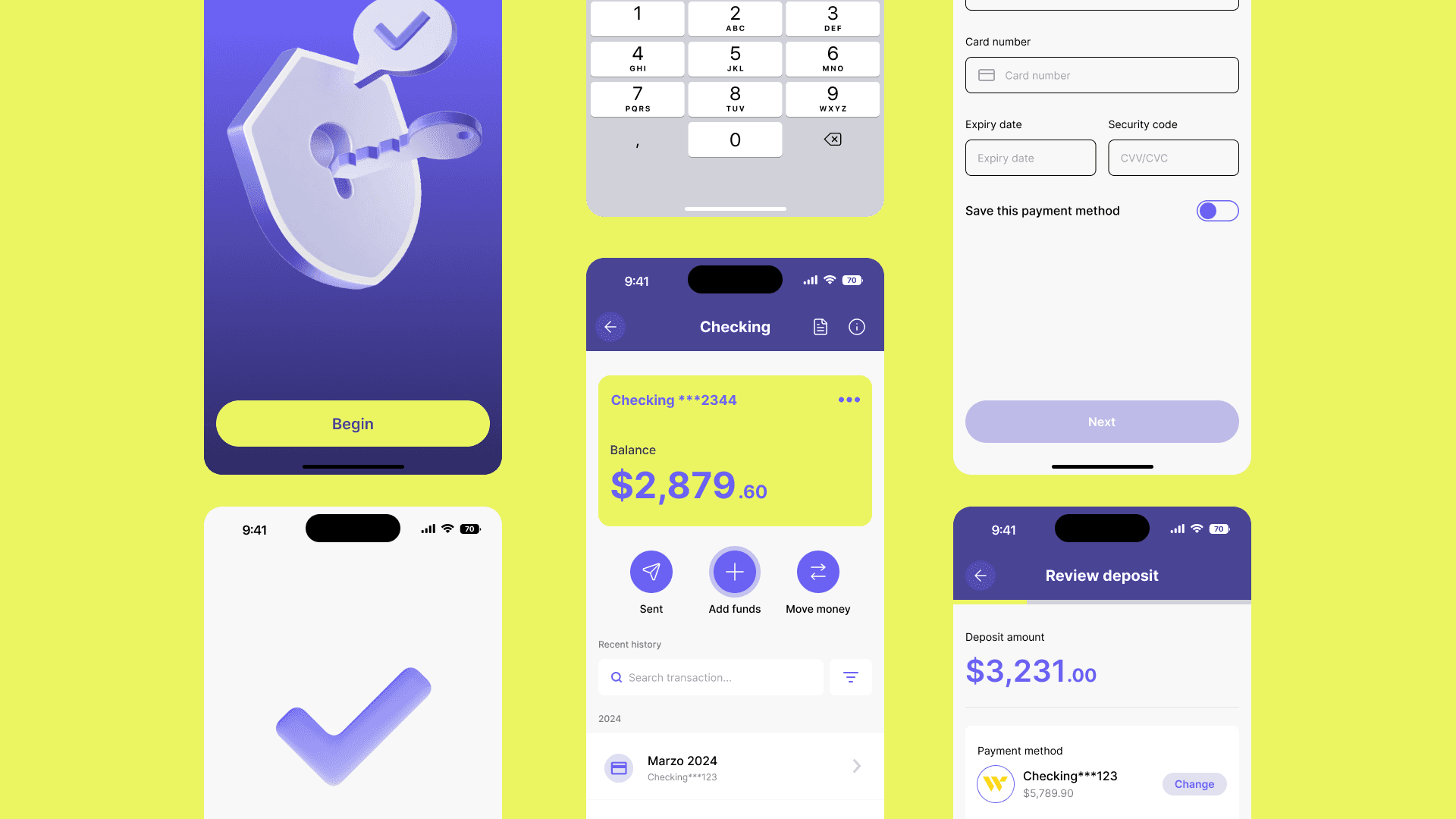

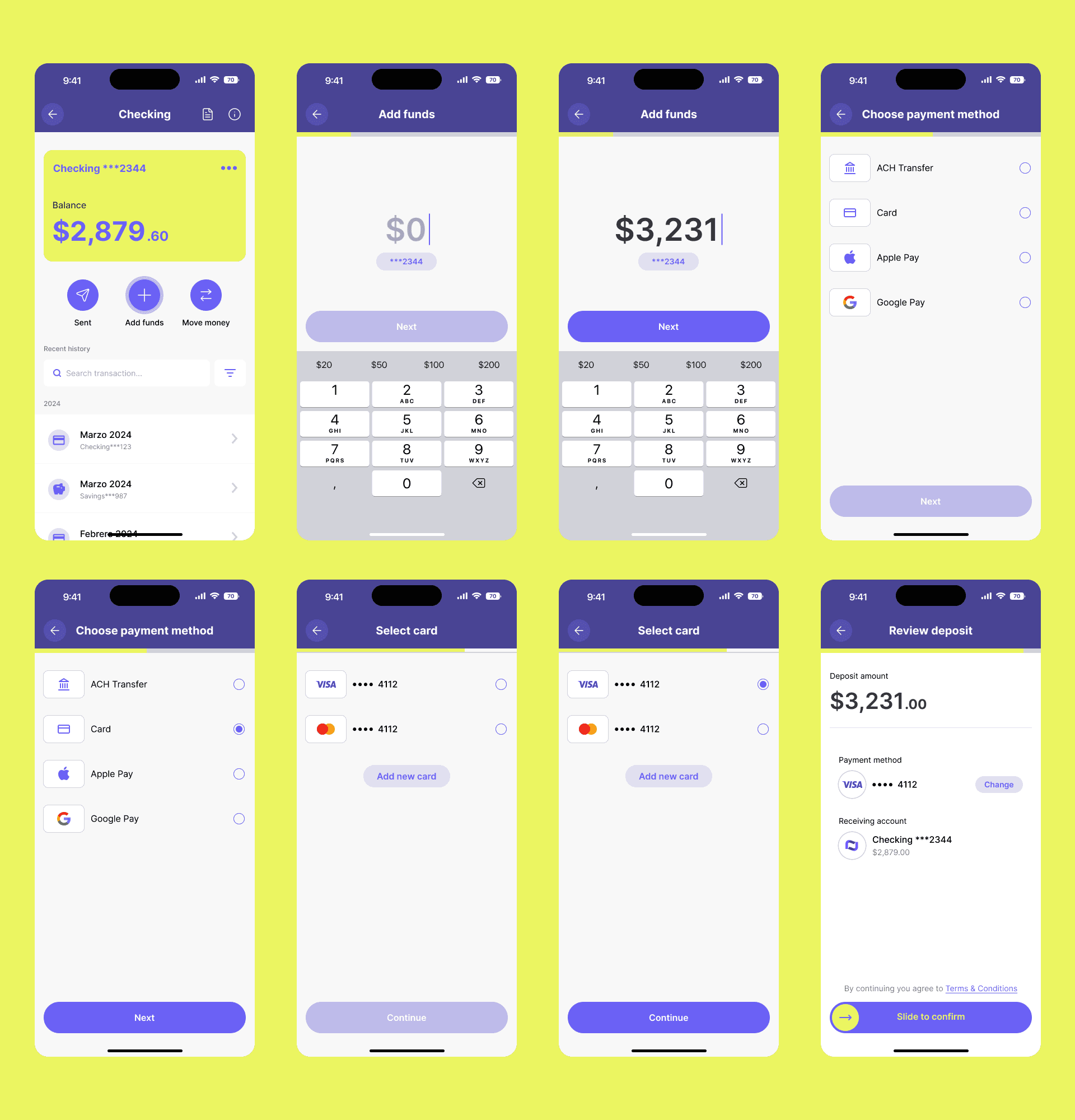

UX

We conducted extensive wireframe explorations to cover a wide range of user scenarios and payment methods. By iterating on various layouts and interactions, we ensured that the design was both intuitive and adaptable. These explorations allowed us to identify the most effective ways to integrate ACH, wire transfers, credit/debit card payments, Google Pay, and Apple Pay into a unified, seamless user experience.

Deposits

Designing the deposits flow was a critical component of the Nuvi platform, as it directly impacted user trust and the overall user experience. The goal was to create a seamless, secure, and intuitive payment process that would accommodate the diverse needs of our global user base.

Results & Learnings

User Growth

The launch of Nuvi was met with positive feedback from users, particularly praising the ease of the onboarding process and the clarity of the interface. Within six months of launch, Nuvi saw a 30% increase in user sign-ups, with high engagement rates on the platform.

Increased Deposits

By implementing advanced security measures, including multi-factor authentication and end-to-end encryption, we not only ensured compliance with U.S. banking regulations but also significantly boosted user confidence in the platform. This led to a 120% increase in deposit volumes, as users felt more secure entrusting their finances to Nuvi.

Financial Diversity

Research revealed the importance of designing a platform that could bridge geographical finance differences, accommodating the expectations and needs of a diverse global user base. We had to ensure that our platform was not only compliant but also intuitive and accessible to users with varying levels of familiarity with U.S. banking practices.

Nuvi was a unique opportunity to create a digital banking solution that addressed a significant market need for a diverse set of users. Through research-driven design and close collaboration with stakeholders, we delivered a platform that not only met regulatory standards but also provided an intuitive and frictionless experience.